Canada Life

A Brief Overview of Canada Life’s Offerings

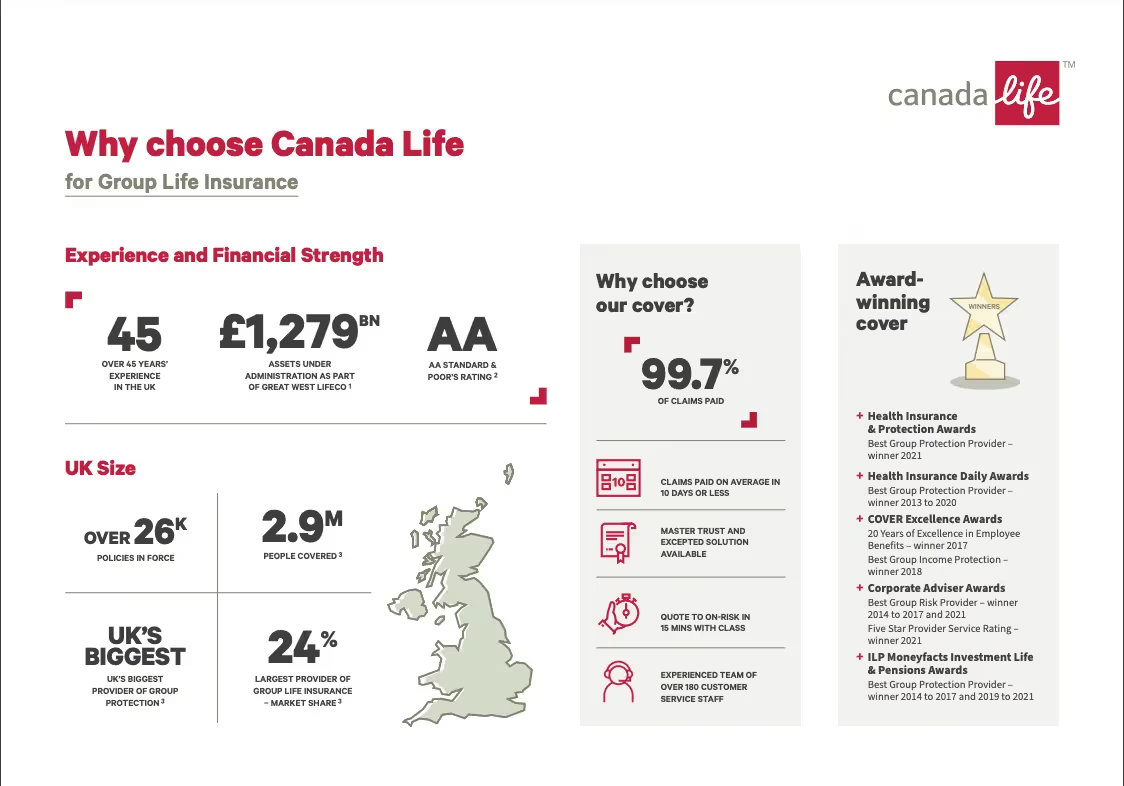

Canada Life is one of the UK’s leading providers of group insurance solutions, offering tailored products that support financial security and employee wellbeing. Their portfolio includes Group Life Insurance, Group Disability Insurance, Critical Illness Insurance, Spouse’s Critical Illness Insurance, and Spouse’s Life Insurance. These solutions provide peace of mind and financial stability to employees and their families, addressing a wide range of potential life events such as illness, disability, or death.

The Main Benefits for Employees

- Holistic Financial Protection: Canada Life’s insurance products are structured to provide employees and their families with comprehensive financial security. Whether through income replacement during disability or a lump sum payout after a critical illness diagnosis or death, the coverage ensures stability during challenging times.

- Support for Families: By extending coverage options to spouses, employees gain peace of mind knowing their loved ones are also protected. Spouse’s Life Insurance and Spouse’s Critical Illness Insurance reduce the financial burden on households when unexpected events occur.

- Customised Coverage: Employees can select coverage levels that align with their individual needs, allowing them to prioritise their financial goals and family requirements. This flexibility makes Canada Life’s offerings accessible to a wide demographic within the workforce.

- Proactive Wellbeing Services: Beyond financial support, Canada Life offers value-added services like rehabilitation programs, grief counselling, and legal advice. These initiatives address the emotional and practical aspects of navigating life’s challenges.

- Peace of Mind During Life Events: Employees are better prepared to handle significant life events, such as a serious illness or a disability, knowing that their benefits provide a safety net for medical expenses, caregiving needs, and other financial demands.

The Main Benefits for Employers

- Strengthened Employee Loyalty: Providing comprehensive insurance coverage signals a strong commitment to employee wellbeing. This can lead to increased job satisfaction, reduced turnover, and a positive reputation as an employer of choice.

- Customizable Plans to Fit Budgets: Canada Life offers employers the ability to design bespoke benefits packages that align with both workforce needs and budgetary constraints. This flexibility ensures maximum value without overextending resources.

- Workplace Productivity and Engagement: Employees who feel secure about their financial futures are more focused, engaged, and motivated at work. Offering a robust benefits package reduces stress, helping employees concentrate on their roles.

- Cost Efficiency through Group Coverage: Group insurance policies are often more cost-effective than individual plans, enabling employers to provide high-value benefits at competitive rates.

- Risk Mitigation and Compliance: Group Life and Disability Insurance ensure compliance with industry regulations and mitigate financial risks for the organisation by providing structured support for employees during times of need.

Special Features You’d Like to Highlight

- Return-to-Work Programs: Canada Life supports employees recovering from long-term illnesses or disabilities with tailored rehabilitation and reintegration services, ensuring they transition back to work smoothly and confidently.

- Second Medical Opinion Service: Through partnerships with leading medical experts, employees and their families can access second opinions for critical diagnoses. This empowers individuals to make informed healthcare decisions.

- Comprehensive Spouse Coverage: Few insurers match Canada Life’s robust offering for spouse coverage. Spouse’s Critical Illness Insurance and Spouse’s Life Insurance ensure that families have financial support in case of serious illness or death, going beyond standard employee benefits.

- Efficient Claims Handling: Canada Life is known for its quick and seamless claims process, ensuring that employees and their families receive support without unnecessary delays during stressful situations.

- Employee Assistance Program (EAP): Canada Life’s EAP provides employees and their families with 24/7 access to counselling, mental health resources, and practical advice for navigating financial and personal challenges.

- Focus on Preventative Care: By encouraging proactive management of health and wellbeing, Canada Life’s programs help employees reduce the likelihood of long-term absences and critical illnesses.

Conclusion

Canada Life’s group insurance offerings provide a holistic approach to financial protection and employee wellbeing. By supporting both employees and their families through tailored life, disability, and critical illness coverage, Canada Life fosters a secure and engaged workforce. With additional features like return-to-work programs, second medical opinions, and proactive support services, the company goes beyond traditional insurance to deliver meaningful, life-enhancing benefits. This commitment to flexibility, innovation, and comprehensive care makes Canada Life a trusted partner for employers seeking to build resilient and supportive workplaces.

More resources

Pricing

£8.00 (example)

Similar providers

Meet Ben, the all-in-one employee benefits platform for any company - global, flexible and fully-automated. Request a demo to learn more about how Ben can help offer a wide range of products as employee benefits.